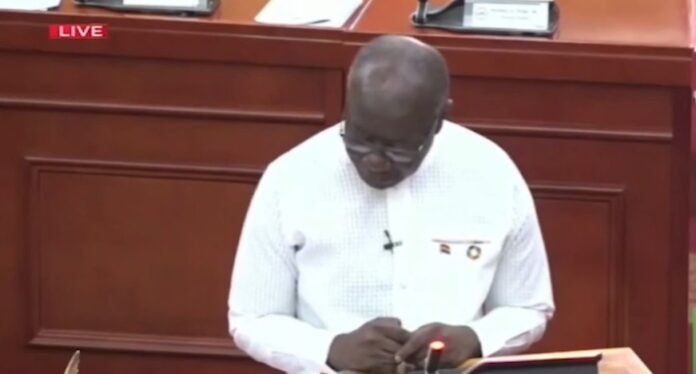

The banking sector of Ghana’s economy posted unexpected, relatively strong performance during the first half of the year, despite the lingering effects of the Domestic Debt Exchange Programme (DDEP), the Minister of Finance Ken Ofori-Atta has said.

He said that the banks have reported increased deposits and investments, higher profitability and a return on equity of over 35 per cent.

Presenting the 2023 mid-year budget review in Parliament on Monday, July 31, the Minister indicated that the impact of the DDEP, such as the increase in nonperforming loans (NPLs), was partly moderated by the timely introduction of temporary regulatory reliefs.

“In the outlook, the operationalisation of the US$750 million Ghana Financial Stability Fund and the planned recapitalisation of banks would ensure stability as well as strengthen financial intermediation to support the private sector,” he said.

Mr Ofori-Atta further said that overall first-quarter growth for 2023 was 4.2 per cent, up from 3 per cent recorded for the same period in 2022.

This growth, he said, largely reflected an increase in the Services Sector which recorded a growth of 10.1 per cent.

Presenting the 2023 mid-year budget review in Parliament on Monday, July 31, he said that headline inflation eased in the first half of 2023.

“From the peak at 54.1 per cent in December 2022, headline inflation gradually trended downwards from 53.6 per cent in January 2023 to 42.5 per cent in June 2023. The moderation in inflation was largely supported by monetary policy tightening, relative stability in the exchange rate and lower and stable ex-pump petroleum prices,” he said.

Cumulatively, he added “the Ghana cedi depreciated by 22.1 per cent against the US Dollar in the year to July 17, 2023, compared to 21.1 per cent in the same period in 2022. The Cedi, excluding the January 2023 depreciation of 20%, has depreciated by an impressive 1.84% between February and July 17, 2023”

Mr Ofori-Atta further said that total export receipts fell by 7.9 per cent to US$8,178.56 million on the back of lower crude oil export receipts. Crude oil exports declined by 41.3 per cent year-on-year due to a 21.4 per cent decline in volumes and a 25.3 per cent fall in prices.

“The current account recorded a provisional surplus of US$849.16 million (1.1% of GDP) compared with a deficit of US$1,111.87 million (1.5% of GDP) for the same period in 2022; and

“Gross International Reserves dropped from US$6.2 billion at the end of December 2023 to US$5.3 billion (2.5 months of import cover) in June 2023, reflecting BOG’s objectives of reducing their foreign liabilities in line with the IMF programme.

“Net International Reserves received a boost from gold reserves and improved to US$2,353.95 million equivalent to 1.1 months of import cover, compared with US$1,440.00 million (0.6 months of import cover) recorded at the end of December 2022,” he told Parliament.

Uniquenewsgh.com News, Politics, African News Updates & More

Uniquenewsgh.com News, Politics, African News Updates & More